How the U.S. Financial Services Sector Can Benefit From the new Financial Transparency Act

PublishedOrganizations like the Global LEI Foundation (GLEIF) have recognized that implementing better identification processes is in the best interest of not only the United States but the rest of the financial world as well. That is why in 2018, they published a report titled “Envisioning Comprehensive Entity Identification for the U.S. Federal Government” in partnership with Data Foundation that called for the U.S. federal government to mandate the use of legal entity identifiers (LEIs).

It appears that the U.S. government has finally listened to these experts because they introduced the Financial Transparency Act on September 24, 2019. This bill became the first U.S. RegTech law and is set to “Put the United States on a path toward building a comprehensive Standard Business Reporting program”.

Here is a further explanation of how the U.S. federal government can expect to benefit from the Financial Transparency Act and its reliance on LEIs.

What Is the Financial Transparency Act?

This proposed law uses a series of strategies to help the eight major U.S. financial regulatory agencies adopt a consistent and accurate database of information as part of the current commodities, securities, and banking laws. It plans to do this through the use of four main techniques:

- The adoption of consistent data standards for all eight major U.S. financial regulatory agencies led by the U.S. Treasury Department.

- The implementation of the global LEI system to help provide consistent information from separate reporting regimes.

- Publishing required data online as open information that is downloadable in bulk, electronically searchable and does not require certain licenses.

- Submitting only one copy of financial statement reporting to the Securities and Exchange Commission (SEC) in the inline XBRL format.

What Is the Current Legal Identity System Used In the United States?

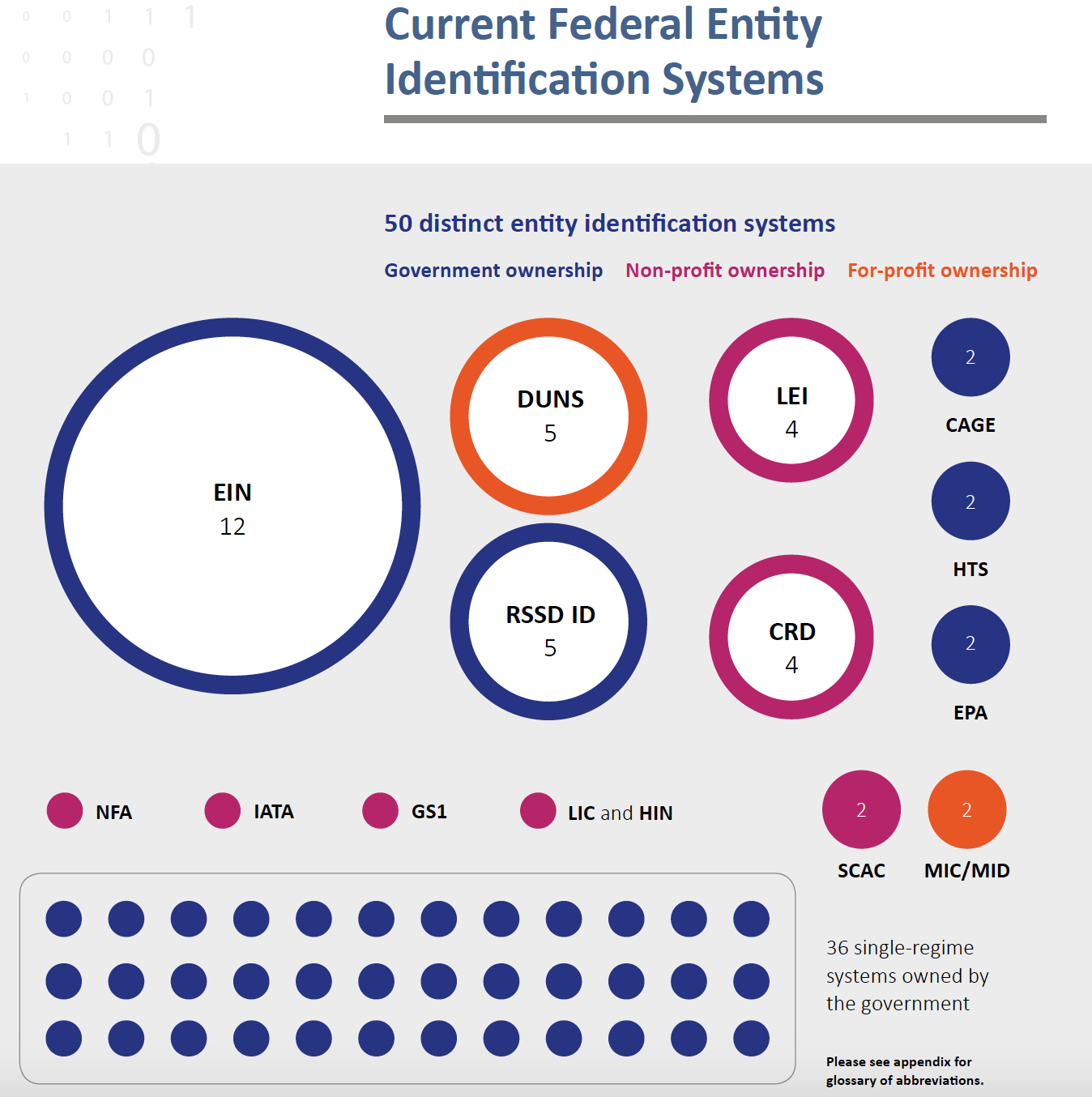

Through an examination of the United States’ eight major financial regulatory agencies, GLEIF was able to determine the state of the current legal identity system used throughout the country. The results were extremely disheartening as it showed that there are 50 distinct entity identification systems being used by various organizations.

The biggest system used by far is the Employer Identification Number (EIN), which only accounts for 12 reporting regimes. Meanwhile, only four reporting regimes currently use the LEI system. There are an astonishing 36 single-regime systems owned by the government, which helps to explain its inability to efficiently identify legal entities.

A full breakdown of the current system used can be found in the graphic below.

Why LEI Is a Better Choice

Time and time again, LEI has been proven to be far superior to any other legal entity identification system. After all, there is a reason why the Financial Transparency Act requires the implementation of the LEI system.

Here are the four main ways that LEI is superior to any other option:

- Other federal entity identification systems are far too strict and have a rigid structure that only makes them useful for very specific agencies. However, the Global LEI System is built intentionally to be used by any agency around the world.

- All current federal identification systems are completely controlled by a single agency or company. But with the LEI system, it is decentralized because there is a wide variety of companies who are accredited as a local operating unit (LOU), which allows them to issue LEIs.

- Rather than using proprietary entity data that is only available to a select few, the LEI uses a non-proprietary system that allows its identification data to be accessed by anyone with a public API.

- The Global LEI System incorporates in-depth validation services both at the time of registration as well as during the annual renewal phase. This helps to ensure that the data quality within the system is completely relevant and up to the global standard.

- By passing the Financial Transparency Act and making the LEI system a required part of the U.S. government’s financial regulation operations, it can help create a system that vastly improves its eight major agencies.

Author: LeiLex

Riga, Latvia, LV1058 https://www.getlei.com

16-Feb 2026 01:02:41 Europe/Riga